Yen Carry Trade Explained

- Divit Setia

- Sep 9, 2024

- 5 min read

Updated: May 21, 2025

On July 31, 2024, the financial world was rocked as the Bank of Japan shattered a 15-year precedent by hiking interest rates, sending shockwaves across global markets. This unexpected move triggered a massive sell-off, unravelling the intricate web of the Yen Carry Trade—a strategy that had fuelled investments worldwide. The aftermath? A dramatic stock market crash that reverberated through economies just days later. In this article, we will delve into the intricacies of this incredibly risky trading strategy, explore the factors behind the bold decision of the Japanese government, and unpack the far-reaching consequences that it had, which continue to shape the financial landscape today.

What is Carry Trading?

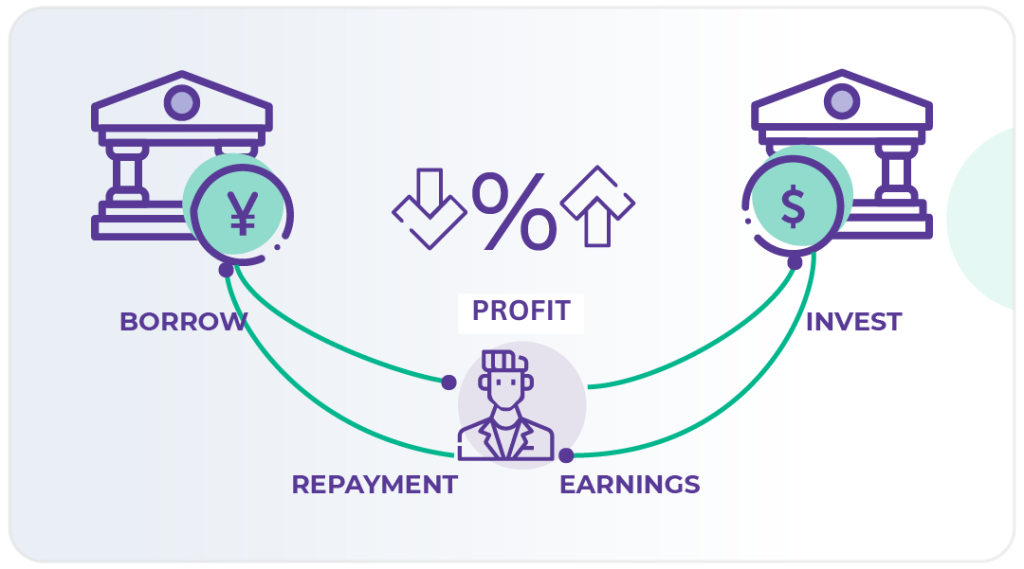

Carry Trading is a high-stakes trading strategy wherein investors borrow a low-interest rate currency, and invest it in an asset in a high-interest rate currency, thereby benefiting from the profits. It basically turns global interest rate differences into potential profits. Think of it like producing t-shirts in India for Rs. 50 and selling them in the US for $5. By borrowing in a low-interest rate currency, like the Japanese Yen, savvy investors can channel these funds into assets denominated in higher-interest rate currencies—ranging from stocks to real estate and in this case other currencies. Sounds like easy money, right? In reality however, this strategy is anything but simple; it’s a game played by experienced retail traders and institutional traders who understand both its rewards and inherent risks.

How does Carry Trading work?

Let’s say you're an investor with a keen eye for opportunities. You notice that interest rates in Japan are incredibly low—just 0.5%. Meanwhile, in Australia, they’re much higher at 4%. Here’s where your strategy kicks in.

Step 1: Borrowing in JPY: You decide to borrow ¥1 million from a Japanese bank at that low 0.5% interest rate.

Step 2: Converting to AUD: Next, you exchange your ¥1 million for AU$10,000 (since 1 AUD equals 100 JPY).

Step 3: Investing in Australian Bonds: You then invest this AU$10,000 in Australian bonds that offer a 5% return. Over time, your investment earns you AU$500.

Step 4: Repayment of Borrowings: Now, it’s time to pay back your Japanese loan. The interest on ¥1 million is ¥5,000, which equals AU$50.

The Profit: After covering the interest on your loan, you’re left with AU$450 (or ¥45,000) as pure profit.

The Yen Carry Trade

Since the mid-1990s, the Yen Carry Trade has become a popular strategy, especially between the Japanese Yen (JPY) and the United States Dollar (USD). Here’s why: the Bank of Japan kept interest rates at rock-bottom levels—think near-zero. This created a golden opportunity for organizations, funds, and hedge funds to borrow massive amounts of Yen at almost no cost and funnel that money into the U.S. markets. With the Dollar consistently gaining value against the Yen and Japan’s interest rates stuck at 0%, investors were essentially doubling their profits. By 2007, it’s estimated that around $1 trillion had been staked into this lucrative trade.

But this begs the question: Why did Japan stagnate its interest rates at 0%?

Well, there are several reasons, lets go over the history of them now.

1. Export-Oriented Economy

Post-WW2, Japan underwent a dramatic transformation, both politically and economically. It transitioned from a sovereign, semi-constitutional monarchy to a de jure sovereign and de facto US-controlled constitutional monarchy. With significant U.S. involvement in its political and economic systems, Japan's government focused on diversifying its economy, moving from textiles to steel, manufacturing, and eventually electronics, with a strong emphasis on exports. This strategy fuelled what became known as the Japanese Economic Miracle, propelling Japan to become the second-largest economy in the world, just behind the United States, and the first developed country in Asia. However, this rapid growth was not to last.

2. Japanese Asset Price Bubble

Fast forward to the early 1980s, U.S. exports became less competitive, pushing the U.S. economy into recession. This led to the U.S. implementing fiscal policies that drove up interest rates, strengthening the U.S. dollar. This shift widened the trade deficit between the U.S. and its G5 allies, including Japan. The Japanese government responded with expansionary monetary policies, which fuelled a massive real estate and stock market bubble. When this bubble burst in 1992, Japan entered a period of stagnation and deflation, known as the Lost Decades, from which it has yet to fully recover.

3. Deflation

Deflation, the opposite of inflation, occurs when prices drop, leading to a situation where the same amount of money buys more goods. While you might think this sounds beneficial, it actually poses a serious problem in modern economies as it increases the real value of debt. Japan's economy slipped into deflation, a condition that persists to this day. To combat this, Japan introduced a zero-interest rate policy that lasted until 2006. However, deflation re-emerged by 2009. In response, Prime Minister Shinzo Abe launched a series of economic policies in 2012, known as Abenomics, aimed at achieving modest inflation (around 2%). These policies even included a negative interest rate from 2016 onwards in an effort to stimulate economic growth.

4. Bank of Japan’s rate hike

On March 19, 2024, the Bank of Japan made a bold move, ending its negative interest rate policy by nudging rates up from -0.1% to 0.1%. Then, on July 31, 2024, they pushed rates even higher to 0.25%—a level not seen since way back in 2009. Bank of Japan Governor Kazuo Ueda justified the hike, stating that the country's economic activity and price levels were aligning with the bank’s projections. He also pointed out that, after factoring in inflation, the policy rate was still effectively negative and hinted that another rate hike to 0.5% could be on the horizon by the year’s end.

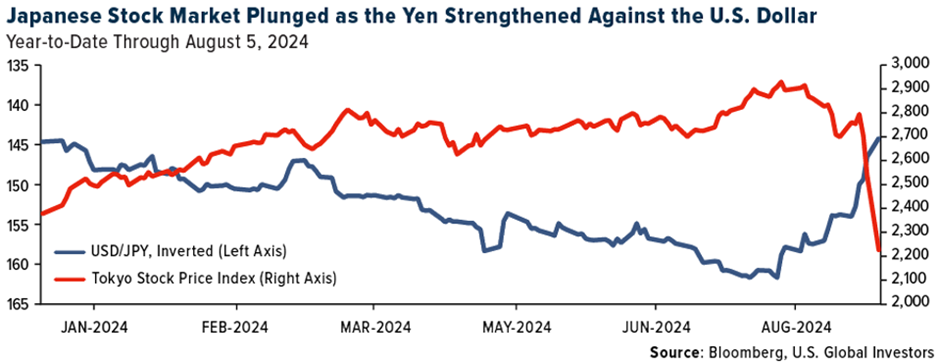

This shift had a major impact on global markets. The Japanese Yen surged against the U.S. Dollar, forcing investors to unwind their carry trades as profits evaporated across the board. To put it in perspective, on July 30, 2024, 1 USD was worth 152.67 JPY. Just a week later, on August 6, it had dropped to 144.68 JPY—a nearly 5% depreciation in just seven days. The ripple effect was felt worldwide: stock markets plummeted, with the Nikkei index suffering a staggering 12.4% drop on August 5, 2024, marking its worst day since the infamous Black Monday crash of 1987. The Tokyo Stock Price Index didn't fare any better, plunging 20.3% from July 31 onward. In the U.S., tech stocks were hit hard, with $2.6 billion wiped out, in part due to the rate hike.

Looking Ahead

As we move forward, the financial markets are likely to face continued turbulence. Governor Kazuo Ueda’s reluctance to rule out further rate hikes signals that the Bank of Japan is prepared to tighten its monetary policy even more, which could send shockwaves through global markets. Investors are bracing for the possibility of more rate increases, which could further strengthen the Yen and exacerbate the unwinding of carry trades.

There’s another layer to this unfolding scenario. Deputy Governor Shinichi Uchida has offered some reassurance, indicating that the Bank of Japan might hold off on additional rate hikes if market volatility becomes too severe. This introduces an element of uncertainty, as the bank navigates the delicate balance between stabilizing inflation and preventing a market meltdown.

At the same time, the U.S. Federal Reserve is reportedly gearing up for rate cuts later this year, likely influenced by the upcoming elections, which have already had their fair share of drama. If the Fed lowers rates, the interest rate differential between the U.S. Dollar and Japanese Yen would narrow even further, putting additional pressure on carry trades. This could lead to a more significant unwinding of positions as investors seek safer ground, potentially triggering further declines in global markets.

The interplay between the Bank of Japan’s rate decisions and the U.S. Federal Reserve’s actions will be something to keep a keen eye on, in the coming months. How these two central banks coordinate—or fail to coordinate—on their monetary policies will likely shape the financial landscape for the rest of the year and even further. The situation remains fluid, and investors will be closely watching every move, ready to react as the global economic narrative continues to evolve.

-Divit Setia

Comments