Does India Need a Bad Bank Right Now?

- Danush

- Jul 10, 2020

- 4 min read

A ‘Bad Bank’ is not a phrase for an underperforming or a corrupt bank, despite how it’s used in common parlance. A ‘bad bank’ is a corporate structure set up to buy the bad loans and other illiquid holdings of other banks / financial institutions. This helps the banks clear many Non-Performing Assets (NPAs), off its balance sheet, subsequently encouraging the banks to ramp up lending. They aim to provide assistance in times of crises, by relieving some NPA pressure off the banks, as lending is crucial during such times, improve their own credit worthiness, and affirm the health of banks in the eyes of the existing and potential investors.

As the country, amidst a global pandemic, finds itself under an economic crisis, The Indian Banks’ Association (IBA) has submitted a proposal to the finance ministry and the RBI to set up a ‘bad bank’ for approximately Rs 75,000 crore worth of NPAs. This article intends to understand the bad bank model and highlight features of the IBA proposal.

How does a Bad Bank Operate?

A Bad Bank may be funded by the government and/or stake holding private investors, in addition to a consortium of banks and other financial institutions stressed by the bad debts.

As a first step towards its sound future, the Bad Bank helps the financial institutions segregate its extremely high-risk assets from the more valuable and performing assets. The NPAs are transferred to the Bad Banks either at book value or, more commonly, at a discounted price. The Bad Bank aggregates these assets, and attempts to manage and recover maximum money out of them.

The recovery may be done through various modes.

They may work out different repayment plans with the stressed businesses through payment discounts, manage and restructure the risky assets themselves, etc.

When a work out plan isn’t feasible, they look to hedge, securitize or sell selected assets/portfolios, chosen through continuous monitoring of the assets.

If the risk exceeds a predefined threshold, the Bad Bank liquidates all the collateral holdings, and tries to recover maximum liquidity possible, as a last resort.

This model has also faced a lot of backlash over the past. The rationale behind the backlash highlights how if states relieve the banks off the loan defaults and remove the risk element off their plate, it encourages reckless lending, possibly compounding the loan defaults problem. Raghuram Rajan, former RBI Governor, has also expressed that the capital to set up such a corporate structure, can instead be directly infused into the struggling banks and directly aid their recovery.

The Bad Bank, however, aims to have an edge over the banks themselves in doing so, through domain experts and focused action on recovery.

To The Rescue!

This model was first proposed in the 1980s, when US-based Mellon Bank created a bad bank back in 1988, the Grant Street National Bank. It served the purpose of resolving bad debt to recover as much money as it could, and was liquidated after it had served the purpose. The Bad Bank model is not novel and is usually set up to recoup in times of financial crises.

IBA’s Proposal

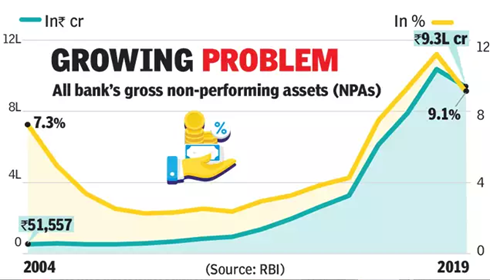

The Indian banking scenario has been severely distressed by the problem of NPAs for quite a few years now, and the Covid-19’s influence on the economy definitely isn’t good news to the issue. Banks must be free to lend, for growth to pick up.

The Indian Govt, after passing on a proposal for a bad bank 2 years ago, called Project Sashakt, by a panel headed by Mr. Sunil Mehta, former PNB Chairman, is now considering its implementation, following a proposal by the IBA. The structure, proposed by the IBA, is expected to follow along the lines of Project Sashakt with a two-tiered structure.

This includes:

An Asset Reconstruction Company which would buy and aggregate bad loans from banks and issue Security Receipts to them.

The second part of this two-tier structure is the Asset Management Company, which would manage the assets, including takeover of management or restructuring of assets

Additionally, an Alternate Investment Fund or AIF which would seek investments through creating a market for trading these Security Receipts.

Few weeks ago, three sections of the Insolvency and Bankruptcy Code (IBC) were temporarily suspended by the Indian Finance Ministry to offer respite to loan-stressed businesses. This decision implies that insolvency of businesses due to debt defaults are suspended for 6 months.

Under such circumstances, where liquidity of assets is not an option, a Bad Bank and its operations that facilitate resolution with the corporates, through its loan repayment plans, as discussed above, may be the only way to go for the banks, with regards to addressing the high risk debts.

The bottom line is that even with a bad bank structure, the NPA losses do not go away, and have to be shared between investors, taxpayers of these banks in general and those of the bad bank; And it merely addresses a symptom, parallel structural reforms are needed.

- Danush

Comments