OPEC's Way to Go

- Economics Association Hyderabad Campus

- Sep 26, 2020

- 4 min read

The Organization of the Petroleum Exporting Countries(OPEC) is an organization of 13 countries that together contain 81.5% of the world's proven oil reserves. It was formed to give these countries collective power over global oil prices and improve their profits.

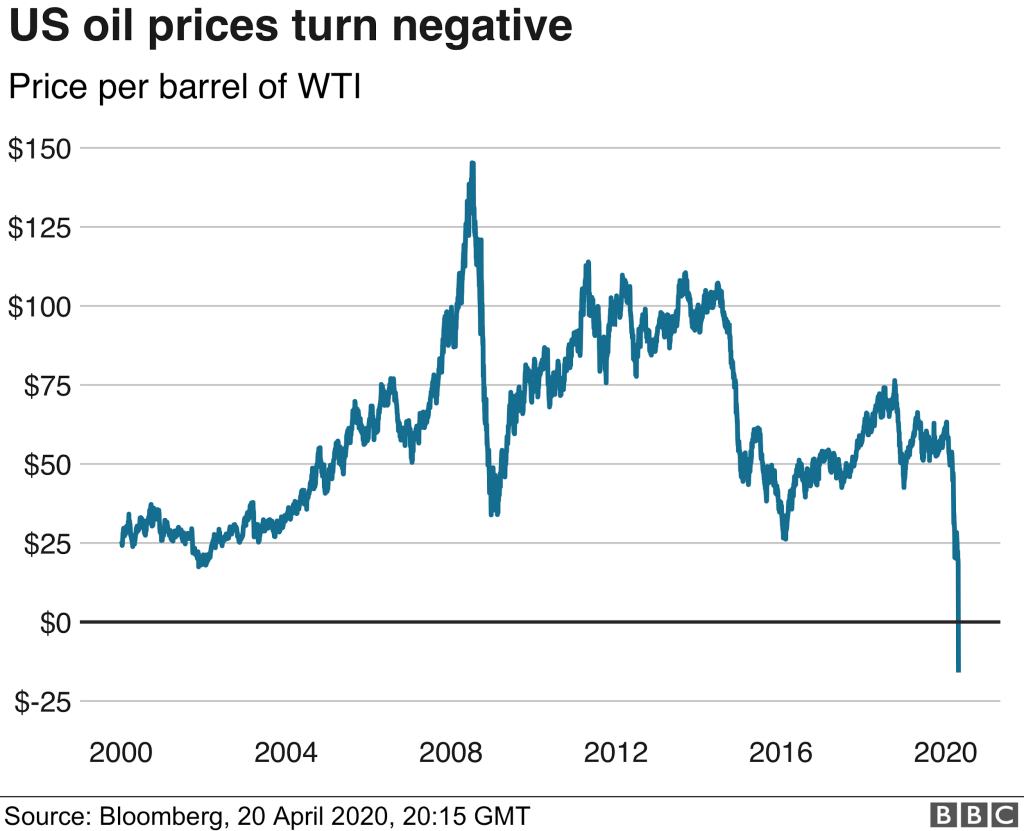

In 2014, while there was a rise in the US shale oil market share, other producers didn’t decrease their supply which led to a price crash from more than $ 114 per barrel in 2014 to about $27 in 2016. To gain more control over the price, Saudi Arabia and Russia agreed to cooperate in managing the price and supply of oil, creating a larger informal alliance called OPEC+.

In March of this year, though, the scene changed when Russia disagreed with OPEC over proposed oil-production cuts during this pandemic. The proposed production cuts were to keep the oil price relatively moderate in a situation where there was a considerable fall in demand. Russia’s refusal led to the fall of the OPEC+ alliance, and oil prices fell 10% after the announcement.

Enraged, Saudi Arabia announced considerable discounts to its customers, which triggered a free fall in oil prices globally. Thus marked the beginning of the economic war between the two countries. On the 10th of March, Saudi Arabia announced that it would increase its production from 9.7 million barrels per day to about 12 million. Meanwhile, Russia had plans to increase production by 300k barrels per day. With decreasing demand and increasing supply, the prices went down further, reaching an all-time low.

The situation continued for the rest of March. However, the low price of oil put a lot of pressure on not just these two countries but on all the oil-producing countries. In April, therefore, the US President Donald Trump was forced to call the Saudi Arabian crown prince and ruler Muhammad bin Salam and threaten to withdraw US military support if they didn't cut down the oil production. The following day, Putin pushed for an OPEC meeting and stated that global production could be cut by 10 million barrels. In response to this statement, prices did jump a bit, but even with a 10 million barrels per day(BPD) cut, it was estimated that global oil stockpiles would increase by 15 million BPD.

Even after all these efforts, the oil prices seemed to be falling with no stop. On the 21st of April, in fact, the price of WTI futures turned negative. That is, the sellers were actually paying the buyers to take the contract away from them. Why would they do that? What is a WTI futures in the first place?

Well, crude oil futures are basically contracts in which the buyers and sellers have agreed to the delivery of a certain quantity of crude oil on a given date in the future at a specific price.

West Tax Intermediate(or WTI) crude oil is a crude oil grade and is one of the benchmarks in oil pricing. It is the main oil benchmark in North America as it is sourced from the United States.

If we add up the information that we now have, it means that the people who bought the WTI futures before had no place to hold the additional oil that they were bound to take in May when the WTI-futures contract expired on the 21st of April. So, they had two options either physically take the oil while spending a fortune for storing it somehow, or they could settle the contract by selling the contract to another buyer. Here, they turned desperate enough to get rid of the contract that they even paid 37 USD to the buyers to take the contract off their hands.

Of course, this kind of thing had far-reaching consequences and affected the entire oil industry. This was about the market in the US, but what about Saudi Arabia and Russia?

Both Russia and Saudi Arabia depend heavily on their oil revenues to sustain their economies. Although Russia's economy is more diversified than the Saudi Arabian economy, they are both in a similar situation, where oil revenues represent a very high share of their GDPs, budgets, and exports. Although the oil war between Saudi Arabia has ended with both countries reducing production, It's hard for either country to survive with such low prices.

Russia needs a price of US$60 a barrel to balance its budget and even a higher price to balance its current account, meaning exports of goods and services minus imports of goods and services, plus net short-term capital transfers.

Saudi Arabia, which is the lowest-cost oil producer in the world, can make a profit when the price per barrel exceeds US$20, and Russia can at a price of US$40. But just making a profit in the business is not enough. Saudi Arabia needs an 80 USD price per barrel to balance its budget and sustain its heavily subsidized economy. The stability of both the Russian and Saudi Arabian political systems and current regimes depends on the oil prices. It is tragic that Saudi Arabia, a country with plans to diversify its income and reduce over-reliance on oil by 2030, faces a crisis in 2020 due to its over-reliance on oil. Saudi Arabia had plans to change its economy based on the money it gains from the oil business. Now though, the dream seems far off with their government relying on debt through extremely long-term bonds to reduce the present burden. They are burning through their reserves even after reducing public spending. The good news is that people have oversubscribed to their bonds, which indicates the market's confidence over them. It remains to be seen, though, about how they will do in time as we don't know how long it will take for the demand to build up enough to increase prices, especially with the current stockpiling of oil.

Especially with the rise of sustainable sources of energy, the future seems to be unknown.

I believe it will be good for Saudi Arabia and the other Arab countries to diversify their economies now, mainly because maintaining their current form will require them to keep taking more debts, and this in no way sustainable. Now, Arab leaders speak of a wave of privatizations to bring in new revenue. They can use the current hard times to establish a more stable future. Obviously, these reforms will be painful and are harder in bad times. But today’s crisis also provides a chance to build vibrant, sustainable economies and representative governments.

Comments