Securities and Exchange Board of India

- Economics Association Hyderabad Campus

- Nov 7, 2020

- 5 min read

The Securities and Exchange Board of India is a statutory regulatory body that was established on April 12, 1992, the year in which the ₹ 5,000 crores Harshad Mehta securities scam hit Indian stock markets. The main aim was to protect the interests of investors in securities, to promote the development and regulation of the securities market and for matters connected to it.

The functions of the SEBI include:

Regulation of business in stock exchanges.

Registration and regulation of stock-brokers/sub-brokers and other such intermediaries, related to the stock market.

Prohibiting insider trading (Insider trading is the kind of malpractice wherein the trade of a company's securities or stocks is made based on information that is not known by the general public).

Prohibiting fraudulent activities and unfair trade practices in the securities market.

It monitors substantial acquisitions of shares and take-over of companies.

SEBI takes on few authorities for the overall development and regulation of the securities market, and to keep the securities market efficient all the time. It composes of three central powers:

Quasi-Judicial: authority to deliver judgements related to fraud.

Quasi-Executive: to implement the regulations and decisions made.

Quasi-Legislative: to frame rules and regulations to protect the interests of the investors.

Through these powers, the body drafts regulations and statutes in a regulatory capacity, orders and passes rulings in a judicial capacity, investigates and thrusts penalties in an enforcement capacity.

Structure of SEBI

The SEBI has a corporate framework, comprising of various departments, with each department allotted head of operations. There are more than twenty departments in SEBI. The hierarchical structure consists of the following members:

The Chairman (present: Ajay Tyagi, nominated by the Union Government).

Two officers from the Union Finance Ministry.

One member from the RBI.

Five additional members by the Union Government of India.

SEBI plays an essential role in regulating all the players operating in the Indian capital markets. Under the Modi government, SEBI was successful in implementing many reforms that helped the securities market prosper. These included primary/secondary market reforms, development of institutions and markets, modernization of stock exchanges, dematerialization of shares, derivates trading, the introduction of the circuit-breaker system, internet trading etc. Few of the most notable reforms that the SEBI was successful in implementing are:

Modernization of Stock Exchanges: SEBI has completely modernized all the operations of stock exchanges by the method of computerization. It has helped scrape on-floor trade thoroughly. The introduction of electronic trading in all the 23 stock exchanges has reduced transaction costs.

Dematerialization of Shares: To correct the slow progress of the depository system, introduced in 1996 to make transactions in stock exchanges' paperless', SEBI introduced an element of compulsion that made dematerialization of shares compulsory in trading. It has helped remove the fear of fake or forged shares, bad deliveries and has eliminated transfer problems.

Primary/Secondary/Capital Market Reforms: These reforms have helped in A. Removing inadequacies in the procedure of issuing new shares and debentures, B. Increased efficiency of the secondary market (this was done by laying down specific rules and regulations for intermediaries like merchant bankers, portfolio managers, underwriters, registrars, brokers and sub-brokers etc. which they had to adhere to, and were penalized in case of default.).

SEBI under U.K Sinha

U.K Sinha is the former and one of the most potent Chairman of the SEBI. SEBI under Sinha has taken on politically connected promoters, shadow banks (the weak underbelly of Indian financial system) and has also worked on probing allegations against large business houses when it comes to corporate governance. One such case relates to real estate DLF Ltd. one of India's largest real estate developers. SEBI banned DLF from accessing the securities market for three years, after finding them guilty for misleading investors by furnishing wrong information. The body has also imposed a penalty on the company.

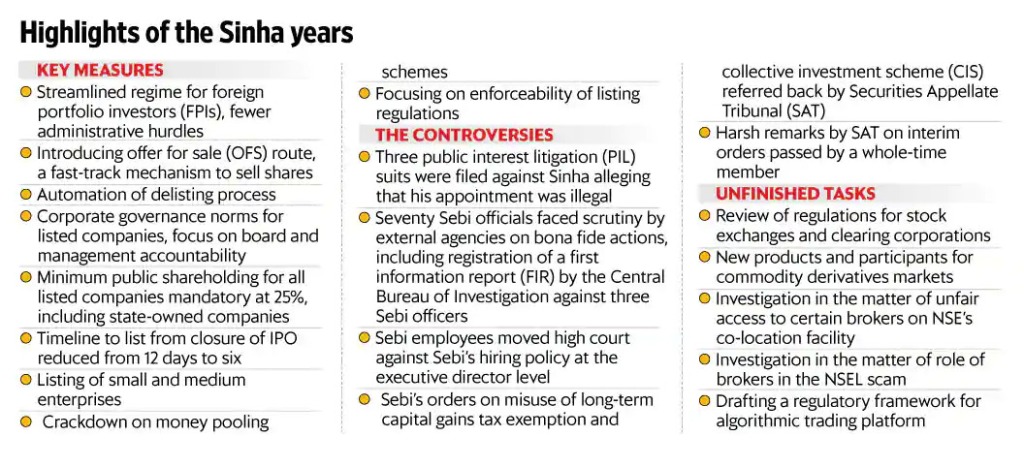

In the six years that Sinha served (with two extensions under the Modi government), SEBI expanded its role as a market developer, adding to its role as a market regulator. In Sinha's tenure, SEBI saw more than 50 amendments, with almost every regulation reworked and re-examined, attesting to the dynamic nature of the regulator. One such amendment was in the period of an IPO closure to listing - to six days from twelve. This helped fast-track listing.

A real challenge for Sinha in his term was to convince the government to have independent directors on the boards of companies owned by the state (and were listed) and have at least one woman director. He penalized almost fifty firms (owned by the government) for not having woman directors in their list of board of directors. SEBI also opened up Institutional Trading Platforms to list SMEs; Small and Medium Enterprises. Under Sinha's guidance, SEBI significantly formalized the listing process and the initiatives regarding the same. More than 200 SMEs had listed in ITPs in his tenure.

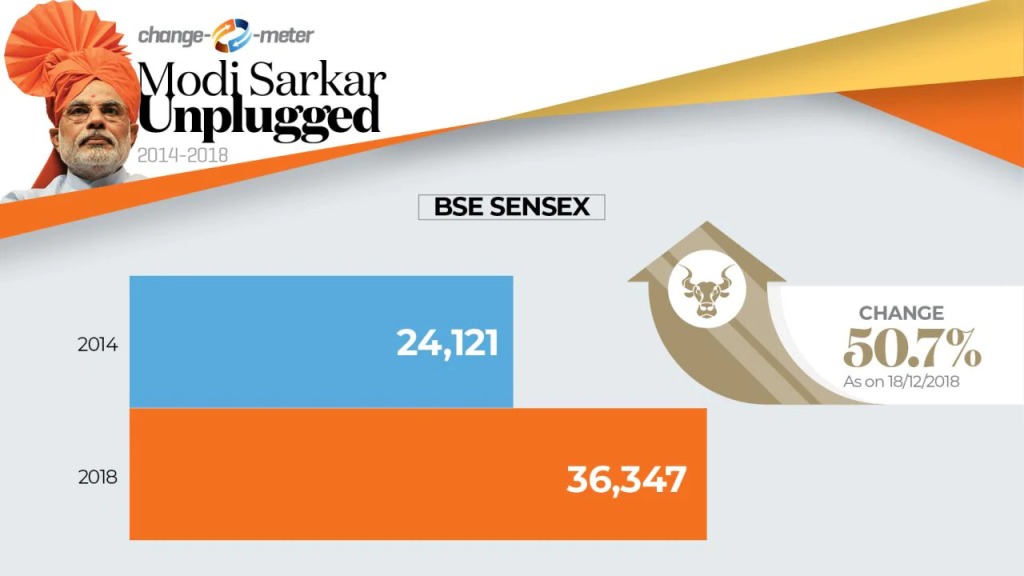

As Sinha left SEBI, he left behind a legacy of critical reforms which have had and will have a consequential impact on the Indian economy. The Sensex, BSE’s benchmark equity index gained 63% or 11,014.71 points (1,281.42 points shy of its all-time high) since 18 February 2011, when he took over.

SEBI Under Ajay Tyagi

Ajay Tyagi, an Indian Administrative Service (IAS) officer, is the current Chairman of SEBI. Under Tyagi, SEBI initiated an informative process for drafting regulations, preventing the influence of special interests on the market regulator.

One of the most significant achievements of Tyagi is how he handled the impact of the pandemic. SEBI, under his leadership, mostly focused on relaxing compliance needs for regulated entities and ensured that markets were not manipulated amid high volatility. During the nationwide lockdown, SEBI relived many norms that included allowing participants to trade from home, relaxing registration timeline and extending result filing dates for companies.

With such strong chairmen, SEBI has grown very strong in recent years. However, some significant issues like the boosting of the corporate market, and redefining the meaning of a promoter remain. The government has played a key role in strengthening SEBI.

Steps taken by the government to strengthen SEBI

To ensure and smooth and regulated development of the capital and securities market, the Government of India promulgated an ordinance for amending SEBI Act. Due to these ordinances:

SEBI was able to respond quickly to market conditions, and this helped to reinforce its autonomy.

SEBI has been authorized to file complaints in the courts without prior approval from the government.

SEBI now possesses the authority to summon the attendance of different categories of market intermediaries, along with persons engaged in securities market to investigate irregularities in the capital market. This means that SEBI can more smoothly issue directives to all intermediaries and persons related to security markets.

SEBI is now endowed with regulatory powers over companies in respect of issuance of capital, the transfer of securities and other subjects regarding the same.

fdhfgdfg dhrthtrhrtc securities lawyer new york rthrhrt