The Finance Sector

- Economics Association Hyderabad Campus

- Jan 17, 2021

- 6 min read

What is Finance?

Finance is a very broad term. We usually define it based on what we perceive and other services we perform in our daily lives. The term is actually used to describe activities associated with banking, leverage (debt), credit, capital markets, money, and investments. Basically, finance constitute money management and the process of acquiring the needed funds. Finance also encloses the oversight, creation, and study of money, banking, credit, investments, assets, and liabilities that make up financial systems. We will look at two important aspects of finance, namely, financial services and financial activities

Financial Services: Financial services are the processes through which we, consumers, and businesses acquire financial goods. One straightforward example is the service of a payment system provider when it accepts and transfers funds between two parties. This also includes the accounts settled via checks, credit and debit cards, or electronic funds transfer. Financial services are not the same as financial goods. Financial goods are products, such as mortgages, stocks, bonds, and insurance policies; financial services are tasks—for example, the investment advice and management a financial advisor provides for a client.

Financial Activities: Financial activities are the initiatives and transactions that businesses, governments, and individuals undertake. They are activities that involve the flow of money. Examples include buying and selling products / assets, issuing stocks, initiating loans, and maintaining accounts. Some common financial activities include company selling shares and making debt repayments, individuals taking out loans and governments levying taxes.

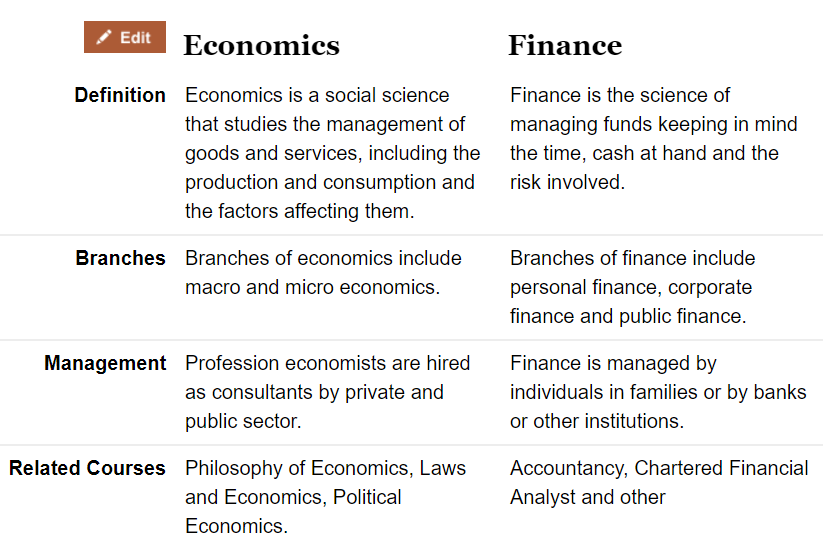

What is the difference between Economics and Finance?

Mistakenly, most people, including me, tend to use the term economics and finance interchangeably. It is very important that one understands the difference between them clearly because waterfall and rivers are not same, right? Or are they?

Economics explain the factors involved in scarcity or surplus of goods and services that affects and can be applied to almost every sphere in society, business, and government. Whereas, finance mainly involves the flow of cash by for example, saving or lending of money, keeping in mind the time available, cash at hand, and the risk involved. Economics is full of theoretical concepts; finance, on the other hand, is the right extension of these concepts. Finance can thus be considered a small subset, or a cousin, of economics. In simple terms, economics and finance are just two sides of one coin. If you want to succeed in finance, you need to know economics well.

The branches of economics include:

Macroeconomics: as the name suggests, it takes into account the broader aspects of the economy as a whole. It includes national income and output and also considers the unemployment rate, inflation of items, and the effects of monetary and fiscal policy of the government on the whole nation.

Microeconomics is the analysis of supply and demand of goods. It includes studies of market to examine the quantity of goods in demand and those supplied, to reach equilibrium at a price point under government regulation. It covers the aspects on a private/personal level, for example, household level or small personal businesses.

The key areas in finance include:

Personal finance relates to the income, source and expenditure of individuals and families, including debts and other loan obligations.

Public finance is concerned with the administration and paying of collective or government activities.

Business finance or corporate finance includes managing funds for a business or corporation. This includes balancing risk and profitability, to maximize the company’s wealth and value of stock in the market.

History and evolution of Economic Thought and Finance

The history of economics can be divided into three phases, premodern, early modern and modern era. Premodern era can be traced back to Mesopotamia and other civilizations like Chinese, Indian, Greek, Arab, Persian, and more. The most notable work that deserves special mention is “Arthashastra”, written by Chanakya, which is now considered one of the forerunners of modern economics.

In the premodern era from 16th-18th century two groups emerged, mercantilists and physiocrats. The former believed that a nation’s wealth was determined by the amount of gold and silver it held and the latter group believed that agriculture was the basis of wealth.

Classical economics was defined by Adam Smith in 1776 in the modern era. According to him, an ideal economy was self-regulating, and the personal interests of the individuals led to the benefit of the whole society.

Modern economics is divided primarily into two schools, Saltwater school (which is associated with Harvard, MIT, Berkeley, Pennsylvania, Yale and Princeton) and Freshwater school (represented by Chicago School of Economics, Carnegie Mellon University, University of Rochester and University of Minnesota). Both these schools of thought follow the neo-classical synthesis. Theories in Finance have a history in economics. Earlier, detailed analysis of financial markets was not done by economists. The main developers of Finance Theory are Irving Fisher, John Maynard Keynes, John Hicks, Nicholos Kaldor and Jacob Marschak.

Feeling bored after reading so much of history? Let’s look at some current world-renounced pioneers in finance are:

Warren Buffett – CEO of Berkshire Hathaway.

Amadeo Giannini – Founder Bank of America.

Henry Kravis – Co-founder KKR & Co. Inc.

Stephen A. Schwarzman – CEO the Blackstone Group.

David Tepper – owner of the Carolina Panthers (NFL) and Charlotte FC (MLS)

Future in Finance

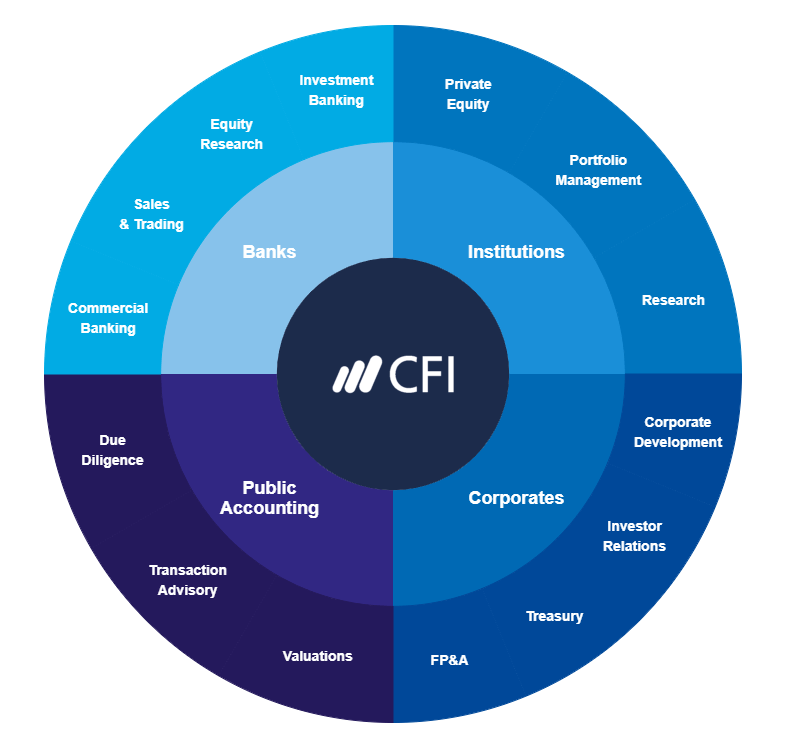

Coming from the cinematic world to reality, neither it is a piece of cake to become the Wolf of Wall Street nor should you exploit the flaws to scam the system like Harshad Mehta. Innovation, skill-set and strategic goal is the key to succeed in Finance sector. Here is a brief introduction to some job opportunities in finance sector that might interest you. Some of them are also offered in our institution.

Financial Analyst: looks after company’s finances, poring over data, and supporting financial management decisions. They evaluate the possible outcomes of business and investment recommendations. Generally, they are hired in junior and senior capacities in banks, insurance companies, and other financial institutions.

Business Development Manager: recognizes sales leads, pitch goods or services to new clients and maintain a good working relationship with new contacts. They follow up new business opportunities and set up meetings and communicate new product developments to prospective clients.

Financial Advisor: are professionals who recognize short-term and long-term financial goals for their clients and recommend the most suitable products and services to achieve them.

Portfolio managers: are initially responsible for creating and managing investment allocations for private clients. Some of them work with individuals and families, while others focus their attention on institutional or corporate investors.

Financial Software Developer: are employees that design, develop, test, and maintain software and other programs that align with the company and end-users’ needs. Fintech, an emerging space for software developers, proposes efficient delivery of financial services and associated activities. For example, mobile payments, stock trading applications, budgeting apps, and cryptocurrencies.

Chief Financial Officer: The CFO has the duties of managing a company’s capital structure and cash flow and planning for its future growth. Therefore, the CFO must have in-depth knowledge of accounting and financial modelling, among other skill set.

Management Analyst: works to improve the business performance. They examine specific issues and develop solutions to improve efficiency.

Future of Finance

The world of finance is changing at breakneck speed due to the rise of the internet and big data. Technology and consumer demands are changing with time which influences the next generation of banking. Today’s fintech startups don’t even have brick and motor stores, relying on cloud technology. This fundamental shift in how banks provide and market their services has sent seismic shocks throughout the industry. This leads to the question, what next for the finance industry?

Traditional high street banks systems and infrastructure which were designed more than 40 years ago, not-surprisingly has weaknesses, and these weaknesses have been exploited by fintech banking platforms such as Monzo and other disrupters, who are characterized by interoperability, modular system design, API management, and cloud computing. Hence, they will either need to invest a heavily in their infrastructure and play catch up or embrace partnerships with fintech’s to bring banking into the 21st century.

The rise of artificial intelligence: The finance industry cannot continue to function without the help of technology; as technology is already ingrained in the industry and there is no way that they can be separated. Artificial intelligence and cybersecurity will be used widely in the industry in the next years to come. This allows for jobs to be automatically processed and done as soon as they come in. Apparently, there will be an increase in demand for software engineers and developers to run the systems from the back end.

The Rise of Cyber- Security Banking is a trust business. It is critical that investors trust the bank, so Banks and other big institutions are constantly fighting cyber-attacks, the number of attacks across the globe is increasing exponentially. With the rise of fintech’s and the fall and rise of Bitcoin (an online, crypto currency) all point to the idea that future is online and for any bank this means they need to invest in cybersecurity to protect their assets and customers.

After going through this article, if you feel finance interests you and want to explore it, our institution provides us with great opportunities. There are various courses you can choose regardless of the branch/stream you’re currently studying in. I would suggest you to go through this link to know more and feel free to contact any of the senior for the same.

References:

Comments