The Hong-Kong Conundrum

- Chetan Reddy Madadi

- Jun 22, 2020

- 8 min read

Hong Kong is an important city in Asia as it plays a vital role in international trade in many countries. Despite being just a small city with a deep water port as its only asset, Hong Kong has overcome many difficulties in establishing itself as a powerhouse economy and is an essential financial center comparable to New York, London, and Singapore. This article navigates through a part of Hong Kong's history on how it established itself and later, helps us gain a clear idea of its current situation and then speculates on its future.

History

It all began in the 1840s when Britain started selling the banned product- opium in China, which led to a war between the two of them that resulted in China's defeat. As a result, Britain imposed a treaty that opened trade with China and granted some territory to itself. After a series of other events, Hong Kong was "leased" to Britain for 99 years(to end in 1997), after which Hong Kong would be returned to China.

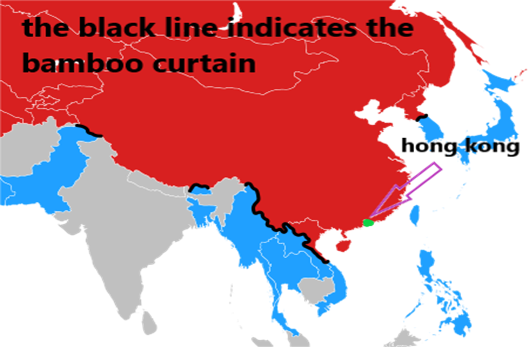

Following this event, Hong Kong, a small island with a humble origin, started growing at a rapid pace, as its location is very convenient for the West's transshipment of goods. It acted as a base of operations for British colonial trade and connected the east to the West. This benefit of being China's neighbor helped till world war 2, after which mainland China fell to the communists, and China's involvement in the Korean War brought a halt to all United Nations trade with China. A border of sorts named “The Bamboo Curtain” had formed between the Communist countries of East Asia, particularly China, and the capitalist and non-Communist countries of East, South, and Southeast Asia, with Hong Kong finding itself right on its edge. Hong Kong's export to China dropped from 40% of its total to around 4% in just a few years. Along with this, refugees from China doubled its population. The situation was dire, and Hong Kong had to look for a solution fast.

To survive, Hong Kong turned to Businessmen. It offered people in business of all nationalities a stable government, meager taxes, and minimal official interference. Meanwhile, trading with the newly independent countries of Southeast Asia compensated its lack of trade with China. To these countries, trade with Hong Kong, which had rich trading experience was rewarding. With inventories of imported goods warehoused locally, merchants were able to make accelerated deliveries to neighboring countries. Its wide range of commercial facilities and duty-free port encouraged foreign companies to maintain regional sales offices there. With the demand for various goods established, Hong Kong businessmen soon started exploring the idea of manufacturing as well as trading.

As the cold war ended, relations with China did become better. However, with all the time apart from its original country, it started to develop a culture different from that of China as well as Britain.

Although a small number of light industries were already established, expansion had many difficulties, including a lack of fuel and scarcity of industrial sites(Hong Kong is a small city). Despite this, the economic situation was ideal for business in Hong Kong. Also, the influx of refugees and capital from the mainland augmented the existing skilled labor and invested funds. The low tax rates incentivized the businessmen to keep expanding as it was an opportunity for them to earn more from their efforts. Also, Hong Kong's free-market economy distinguished it from other places, which might have similar advantages and brought in foreign investment from various locations.

The Cons

In truth, though, Hong Kong did not turn out to be paradise, and while many companies did expand here and made this city their regional headquarters, too much growth led to other consequences. Hong Kong is just one city with limited land; the influx of immigrants, massive expansion of businesses, and the rise in population led to the land prices soaring through the roof. Also, as the government owns all Hong Kong land, it leases it to private developers and users on fixed terms for fees paid to the state treasury. By restricting the sale of land leases, the Hong Kong government keeps the land price at what some consider as artificially high prices, allowing the government to support public spending with a low tax rate on income and profit. In turn, the cost of living soared and made Hong Kong one of the most expensive places to live. The free market economy though very beneficial is a double-edged sword as it leads to unequal wealth distribution. These two things are a little hard on citizens of the lower and middle class.

An example of this is the graph given below which shows that Hong Kong is the costliest place to own property(This is determined by property price/per capita income of an average household on the y-axis and the years on the x-axis)

Hong-Kong's Success

All that still does not change Hong Kong's success. Its GDP at that time was already more than the GDPs of many countries.

In 1997, when Britain gave Hong Kong back to China, both the parties reached an agreement that Hong Kong would operate as an autonomous entity for 50 years, during which China would run on the "one country two systems" rule. This agreement ensured that for 50 years, nothing fundamental would change about Hong Kong, and both the countries would benefit from this city.

Hong Kong became a part of the People's Republic of China as an autonomous entity and started to act like a mediator of sorts between the USA and China. Its trade with the USA has grown tremendously and has become one of its major trading partners with trade(goods and services) between both the countries totaling an estimated $66.9 billion in 2018. A majority of that trade is accounted for by exports from the USA to Hong Kong. In return, Hong Kong benefits through Foreign Direct Investments in it from the USA.Its importance and autonomy were highlighted when the USA passed a bill stating that it would treat Hong Kong separately from Mainland China for matters concerning trade export and economic control.

The Financial Sector

From the 2000s, China has had meteoric growth. It is now the 2nd largest economy globally, and that growth has led to the rise of huge companies like Huawei, Alibaba, and Tencent, which, like all other public companies, need to raise the money required for their growth. But because China's obscure financial sector is mostly closed off from other nations, many of these companies come to Hong Kong to raise capital. Hong Kong acts as these companies' bridge to the outside world and has raised a lot of capital for them from its popular Hong Kong Stock Exchange(HKE). Even a few prominent state-owned companies in China are listed in the HKE. This is because HKE is an international exchange that gives them credibility on a global stage. Also, it means that these state-owned corporations can get the funding they need in Hong Kong dollars, which are a lot easier to work with globally than Chinese RMB(again, this is because of Hong Kong's international presence).These companies distinguish the already popular HKE from the exchanges in New York and London, earning it a unique place in the world.

Risks and Actions

At the time of its handover, Hong Kong alone accounted for about a quarter of China's economy. Therefore, China was willing to appease Hong Kong by letting it stay autonomous and waiting 50 years for Hong Kong to truly become a part of it. As time passed, however, China grew to become an economic powerhouse. Due to this, Hong Kong now accounts for only about 3% of China's economy; It no longer held the same place of importance in China that it once did. As such, China no longer feels the need to appease Hong Kong and has been asserting its power over Hong Kong much to the city's anger. Thereafter, every "illegal" assertion of the Chinese authority over it was met by strong opposition from its citizens, with many taking to the streets in protest. This movement came to be known as the "Umbrella Movement". But this movement did not change their Central government's mind, to curb the people, China started arresting some of the vocal protestors. To help get the frontliners of their protest out, funds were started to raise money required to pay for their lawyers and to bail people out. The movement started showing results, and it had even forced the government to retract their controversial "extradition bill." But just as the opposition movement was gaining traction, COVID struck, forcing the movement back.

Right now, because of the COVID situation, there is a lack of economic activity and increasing unemployment, as a result, citizens are no longer able to support their protestors by sending funds to bail them.

The mainland not letting go of this "opportunity" has recently passed the first draft of a security law. A law which would make any of the below acts a crime:

secession - breaking away from the country

subversion - undermining the power or authority of the central government

terrorism - using violence or intimidation against people

activities by foreign forces that interfere in Hong Kong

What is worrisome is that given the rubber stamp government of China, the final form of the security law would be passed no matter its contents. Depending on the nature of the law in question, it could mean the loss of the fundamental freedoms which Hong Kong enjoys. With this, China could have free reign in Hong Kong and change anything it dislikes about said city. It puts the autonomy of Hong Kong and the freedom of its traders- the pillars on which Hong Kong has developed, at risk.

Speculating Future

(Read the P.S. under for an update)

Based on how severe the new security law is going to be, Hong Kong might even lose full autonomy and could be operated as any other metropolitan city in China, thereby losing its international presence.With Shanghai, a financial capital within the mainland coming up, many Chinese companies are choosing to raise funds at the Shanghai Stock Exchange as it is much easier to do so here. Companies listing here instead of the HKE don't have to go through the complexity of dealing with a different currency, capital controls, and much more. Also, the Chinese government is massively supporting these mainland exchanges to limit the power of Hong Kong. If Hong Kong is no longer autonomous, it loses its international presence causing HKE to lose its unique place. It then has to compete directly with the Shanghai Stock Exchange. Also, Chinese corporations who seek a global presence like Tencent, Alibaba, and Huawei might accelerate the movement of part of their offices out of China. This is bad both for mainland China and Hong Kong.

The seriousness of this issue is shown with the USA now considering removal of Hong Kong's special status. This would worsen the USA-China trade that was finally beginning to thaw, leading to a considerable loss in both the countries.

With the slowdown of trade with the USA and the decline of its financial sector, many of Hong Kong's citizens would become unemployed and would choose to migrate elsewhere. The migration and loss of trade would finally lead to a downtrend in land prices but at a considerable cost to both the government and private parties. This is because real estate is another massive part of Hong Kong's economy. All this will finally lead to a recession in Hong Kong and might reduce it to a shell of its previous self. It might take Hong Kong years to overcome this predicament.

Thus, while the security law can be very overpowering and might finally unite all of China and consolidate its power, it would negatively impact Hong Kong, China, the USA, and many other countries indirectly.

P.S: China revealed new security law details through its state-run Xinhua news agency on Saturday, 20th June 2020.

According to the released intel, a special bureau in Hong Kong to handle crimes considered threatening to national security is planned. New police and prosecution units will also be set up to investigate and enforce the law. Hong Kong will establish a committee to safeguard the legislation, headed by the city's leader Carrie Lam and supervised by the central government. Carrie Lam will also have the power to appoint judges to hear cases related to national security. Till now, judges were appointed through Hong Kong's independent judicial system.

- Chetan Madadi

Comments