The Price of Prestige: iPhone Pricing in India

- Vidyesh Panyam

- Oct 12, 2024

- 4 min read

Updated: May 21, 2025

The iPhone 16 launched around the world on September 20th, 2024. By now, with iPhones having been around since 2007, you might be desensitized to their hefty price tags. While iPhones are undeniably expensive no matter where you purchase them, India stands out as one of the countries with the highest iPhone prices, despite the country’s lower cost of living. Have you ever stopped to wonder why Apple’s iPhones remain so expensive in India, even though the new models are now being assembled completely locally? Here, we’ll dive into the factors behind Apple's pricing strategy and explore the economics that keep iPhones at the top of the luxury tech market in India.

iPhone 16 Series: A Snapshot of Prices

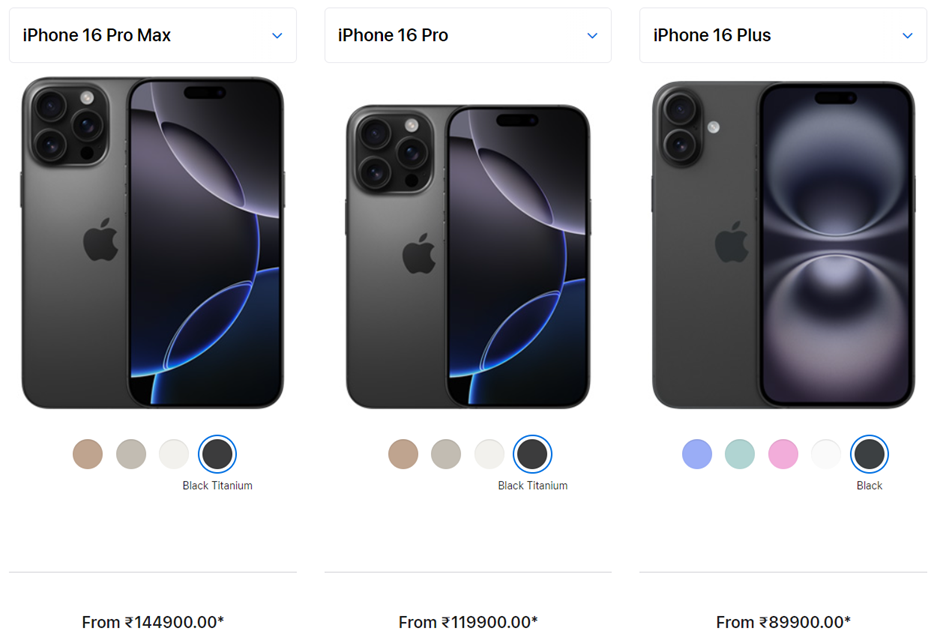

Apple just introduced its iPhone 16 series with four models: the iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max. The iPhone 16 is positioned slightly more competitively, starting at just under Rs. 80,000, while the premium iPhone 16 Plus, Pro and Pro Max models come with significantly higher price tags, as you can see below.

Interestingly, the iPhone 16 Pro series is priced nearly ₹15,000 lower than its predecessor, the iPhone 15 Pro series, at launch. However, it remains significantly more expensive in India as compared to other countries. Let’s take a look at how the prices of the iPhone 16 pro stacks up in countries across the globe.

What is striking from this graphic is that the iPhone 16 Pro Max is almost ₹40,000 cheaper in the USA compared to India. This is more than the monthly salary of the average Indian! This raises an important question: why is the iPhone still so expensive in India, even with its ‘Made in India’ label? Here are the factors driving these seemingly insane prices.

Factors Influencing iPhone Prices in India

Manufacturing Process and Supply Chain

While Apple has been increasing its presence in India since 2016, with local assembly of some iPhone models, it’s important to note that the iPhone 16 series isn’t fully manufactured in India—it’s merely assembled here. The supply chain still depends heavily on components imported from abroad, which adds to the final cost for Indian consumers. It is well known that Apple’s chips are manufactured in Taiwan, with most other parts also originating from east-Asian companies like Samsung and Sony.

Customs Duties and Taxes

Because these parts are imported, India imposes high customs duties on them, as part of its broader strategy to promote local manufacturing and reduce reliance on foreign imports. Apple faces a 22% customs duty on imported parts as a part of the government’s Make in India initiative. This duty is then passed on to consumers. Additionally, buyers in India pay an extra 18% GST, which together can increase the overall price by up to a staggering 40%!

Currency Depreciation

The fluctuating value of the Indian Rupee against major currencies like the US Dollar also plays a significant role. As the Rupee continues to depreciate, the cost of importing components rises, and Apple adjusts its pricing to account for these currency shifts, making iPhones more expensive in India.

Distribution Chain

If you’ve ever noticed, India only has two official Apple stores, while the USA has 270. Because of this, Apple relies heavily on third-party retailers, who often add layers of distribution costs. India’s strict local-sourcing rules delayed Apple’s direct retail expansion for years, making its products more dependent on middlemen, which pushes prices higher.

Apple’s Pricing Strategy

Apple positions itself as a premium brand, and its pricing reflects that. It often prices its higher end products at a premium, so as to make them status symbols. While Apple has introduced more competitive pricing for the iPhone 16, the Pro and Pro max series still maintain a high price to uphold its luxury status. Analysts suggest that Apple keeps margins higher on the Pro models to make the base models and older generations more affordable.

How Apple's Premium Pricing Limits Its Reach in India

Despite the iPhone 16 series being assembled in India, several factors contribute to its high price in the country. The reliance on imported components attracts hefty customs duties, which combined with GST, can increase the price drastically. Currency depreciation further inflates costs, and Apple's limited retail presence in India forces it to rely on third-party distributors, adding additional layers of expense. Ultimately, Apple’s pricing strategy, which positions its Pro models as luxury items, reinforces these high prices, ensuring that iPhones remain premium products in the Indian market.

In a country where price sensitivity is key, these high prices significantly influence consumer behaviour. Most Indian consumers, prioritizing value for money. The steep cost of iPhones often drives potential buyers toward more affordable alternatives. In India, brands like Samsung, Xiaomi, and OnePlus dominate the smartphone market by offering feature-rich devices at much lower prices. As a result, Apple’s market share in India lags far behind, with only 4-5% in recent years compared to over 50% in the USA and 20-25% in Europe and China. In a market with immense potential, the iPhone’s high price point limits its reach, driving many consumers toward budget-friendly alternatives that offer similar functionality at a fraction of the cost.

Conclusion

In conclusion, the iPhone’s premium pricing in India reflects a combination of factors that go beyond simple manufacturing costs. Despite being assembled locally, the reliance on imported components, hefty customs duties, GST, currency depreciation, and a complex distribution chain all contribute to keeping iPhone prices high. Moreover, Apple’s luxury branding strategy ensures that its Pro models remain status symbols, limiting their appeal to a small segment of consumers. In a price-sensitive market like India, where value for money reigns supreme, Apple struggles to expand its market share against competitors that offer similar features at far lower costs. While the brand retains a loyal customer base, it faces an uphill battle to gain significant traction in one of the world’s most competitive smartphone markets.

- Vidyesh Panyam

Comments